1 Finance Blog

Discover financial wisdom on our blog for expert insights on personal finance, investing, and money management.

Making Sense of Money on the Therapist’s Couch

Ask him to help. You need the money. You don’t ask. Instead: panic, anxiety, irritable bowel…

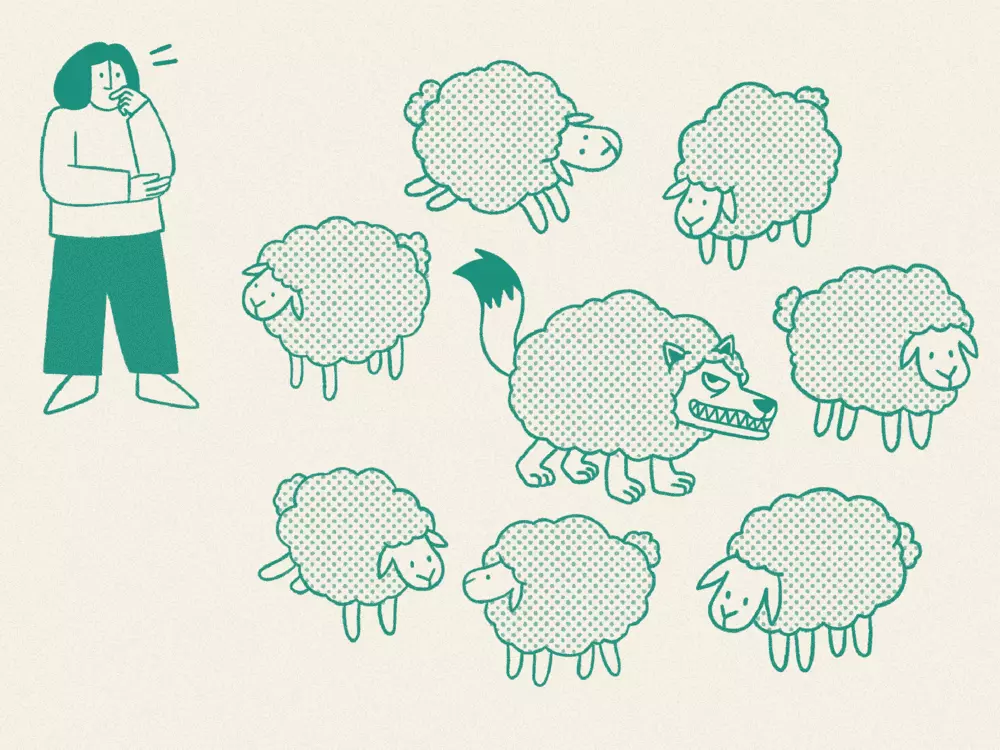

What to Look for in a Financial Advisor

The relationship between a financial advisor and a client is not a one and done process,…

Can I Achieve Financial Freedom by 45?

Dear Qualified Financial Advisor, The amount of information and advice around dealing with money is overwhelming…

Lessons from the Pandemic, by India’s Leading Food Entrepreneurs

The lockdowns were undoubtedly hard on business owners and entrepreneurs across industries. But a sector that…

3 min read

Is Market Risk All You Need to Consider While Investing?

“Mutual fund investments are subject to market risks, read all scheme-related documents carefully.” This all-too familiar…

Can I Plan My Finances to Align with My Ideal Lifestyle?

Dear Qualified Financial Advisor, Over the past few years, I’ve been taking small steps to get…

3 min read

The Tricky Ease of Buy Now, Pay Later Schemes

In a time when the accumulation of commodities has become the norm, it’s easy to believe…

3 min read

Why You Should Consider Refinancing Your Debt

Debt refinancing refers to the exercise of reorganising your debt by replacing your existing loan with…

How Do I Set Up an Emergency Fund?

Dear Qualified Financial Advisor, I’ve been reading a lot about the importance of having an emergency…

The Treasures We Hold Close

How do you ascribe value to an object? Is it how much money it cost? Or…

How Do I Identify an Unhealthy Mutual Fund Investment?

Dear Qualified Financial Advisor, Last year, I started looking for investment options that help with having…

Why We’ve Set Up a Committee for Qualified Financial Advisors

As a financial institution, we think of 1 Finance as a place that takes care of…

Discover your MoneySign®

Identify the personality traits and behavioural patterns that shape your financial choices.