1 Finance Blog

Discover financial wisdom on our blog for expert insights on personal finance, investing, and money management.

3 min read

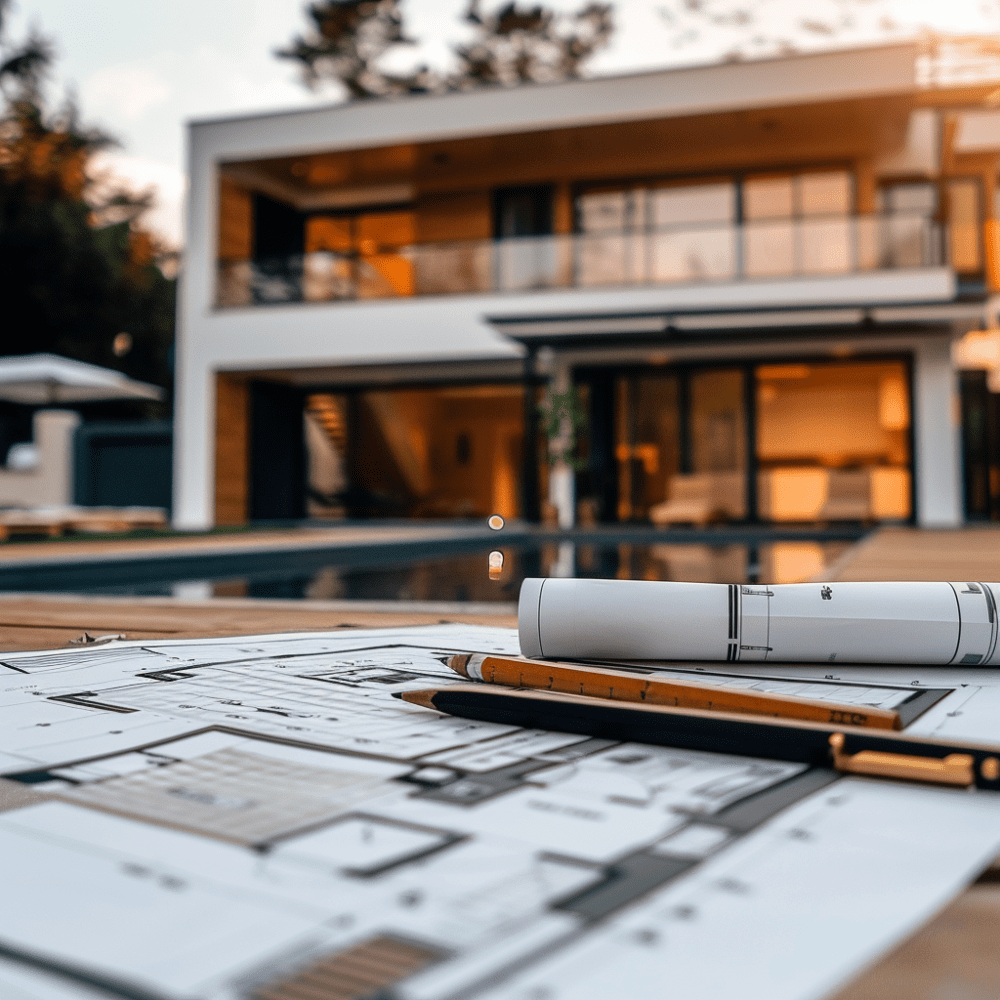

Navigating the Maze of Residential Real Estate Investment in India | “Temperament” by 1 Finance

It is more important than ever to grasp the nuances of residential investment in the quickly…

4 min read

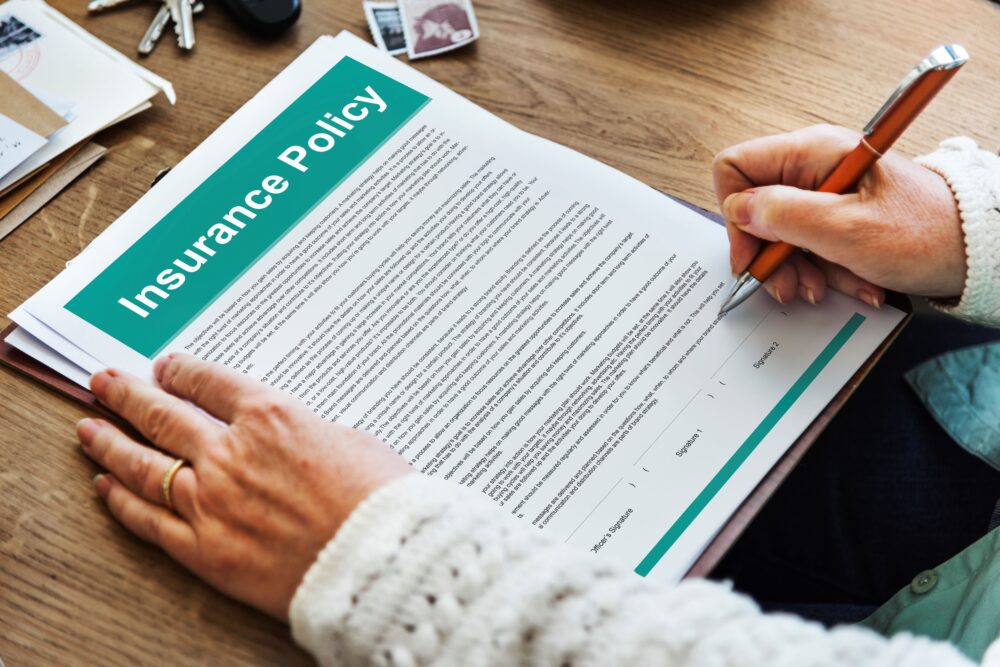

Term Insurance against Home Loan

Are you contemplating the best way to secure your home and ensure your family’s financial stability?…

5 min read

The Big Deal About Investing Early in the Indian Market

Investing early is often emphasised by financial advisors, but what makes it such a big deal?…

2 min read

Income Loss & Emergency Planning: Mastering Resilience in Uncertain Times | Temperament by 1 Finance

In an age where job security is a relic of the past, “Temperament” by 1 Finance…

Is There A Way To Get Better Returns On My Savings While Keeping Assets Liquid?

Dear Qualified Financial Advisor, A few days ago, I caught up with some friends, and our…

3 min read

Mitigating Liability Risks: Strategies for Individuals and Families

This post details strategies and examples on managing liability risks and protecting assets, emphasizing the role…

2 min read

Should You Diversify Your Investments Beyond Nifty 50? Know What Should Be Your First Priority

The Nifty 50 Index has long been a popular investment choice for Indian investors, delivering an…

What is Term Insurance Scoring and Ranking Model?

Selecting the right term insurance plan is a critical step in securing your family’s financial future.…

6 min read

Why Hire Professionals for Tax Planning?

Discover how a CA/Tax expert optimizes tax planning, increasing savings, ensuring compliance, and reducing e-filing errors.

4 min read

Why HRs Must Address Employee Financial Wellbeing Now

The burden of financial stress weighs heavily on many employees, impacting their financial wellbeing. This persistent…

3 min read

Who Do You Trust to Give You Financial Advice?

It appears that everyone is talking about personal finance — watching ads during a cricket game…

3 min read

Unknown Clauses About Life Insurance Policies to Watch

In India, life insurance has long been an emotional decision for families. It remains a push…

Discover your MoneySign®

Identify the personality traits and behavioural patterns that shape your financial choices.