1 Finance Blog

Discover financial wisdom on our blog for expert insights on personal finance, investing, and money management.

3 min read

The Role of Financial Professional Coach in Your Retirement

While navigating the intricacies of retirement planning, it’s essential to recognize the value of seeking expert…

5 min read

Types of Mutual Funds: What Are Different Types of Mutual Funds, How They Differ, and How to Invest in Them

The Indian mutual fund industry has witnessed exponential growth over the past decade. As of December…

4 min read

Will and estate planning: How to smoothly transfer your legacy

Estate planning might sound like something only the high-net-worth individuals or ultra-high-net-worth individuals worry about, but…

3 min read

Why real estate advisory matters more than ever post SC on property ownership and registration

Buying and owning property is one of the largest financial commitments most of us will ever…

5 min read

Tax Season : Aligning Insurance Choices with Holistic Financial Wellbeing

As we approach tax season, it is imperative to consider the critical link between tax planning,…

3 min read

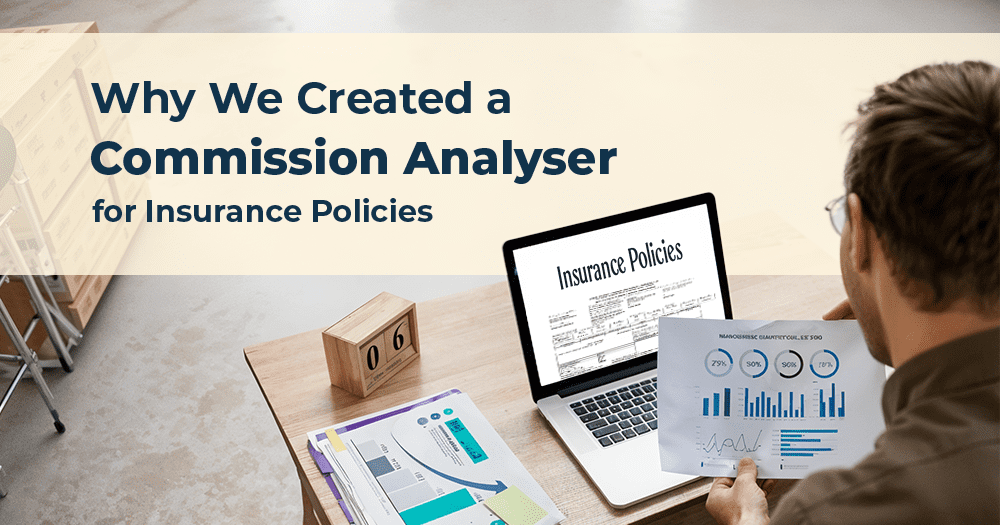

Why We Created a Commission Analyser for Insurance Policies

Among the issues that plague India’s personal finance advisory space, the mis-selling of financial products that…

New NPS rules: What you should know before investing in NPS in 2026?

As we step into 2026, you may be looking for ways to secure your financial future.…

8 min read

Documents needed for divorce in India: Collect the essentials before you file

Here's list of documents needed for divorce in India

4 min read

Navigating the Future: Comprehensive Retirement Planning for Indian Parents | Temperament by 1 Finance

India is on the brink of a profound demographic shift, transitioning towards an ageing society with…

3 min read

What Are Charge Cards? How is it Different From Credit Cards?

Charge cards are a type of payment card that offer financial flexibility similar to credit cards…

3 min read

Boosting Your Credit Score with Timely Credit Card Repayment

This blog examines the link between disciplined credit card usage and improving credit scores, offering practical…

5 min read

How to Choose Best Tax Regime For You | Old Tax Regime Vs New Tax Regime

This blog post compares India's old and new tax regimes, discussing their effects on taxes and…

Discover your MoneySign®

Identify the personality traits and behavioural patterns that shape your financial choices.