1 Finance Blog

Discover financial wisdom on our blog for expert insights on personal finance, investing, and money management.

6 min read

Deduction and Exemptions from Income Tax

Tax planning is essential for effectively managing your finances. Income tax laws offer several deductions and…

3 min read

Understanding Fixed and Variable Income Investments: Where Does P2P Lending Fit?

Investing involves understanding different types of income investments to balance your portfolio effectively. This blog will…

3 min read

How to Close NPS Account

The National Pension System (NPS) is a long-term retirement savings scheme designed to provide financial security…

4 min read

What is Financial Personality?

When it comes to managing money, everyone approaches financial decisions differently. Whether you’re a meticulous planner,…

16 min read

How to financially prepare and protect your assets before divorce

Planning for divorce? Begin with financial planning

3 min read

What is Crypto Scoring and Ranking?

Navigating the dynamic world of cryptocurrencies, especially within the decentralised finance (DeFi) sector, can be challenging…

4 min read

Bank mis-selling insurance in India: Banks made ₹21,773 crore in third-party sales commissions

Mis-selling has spread like a disease in India. Urgent preventive measures are needed to cure it.

4 min read

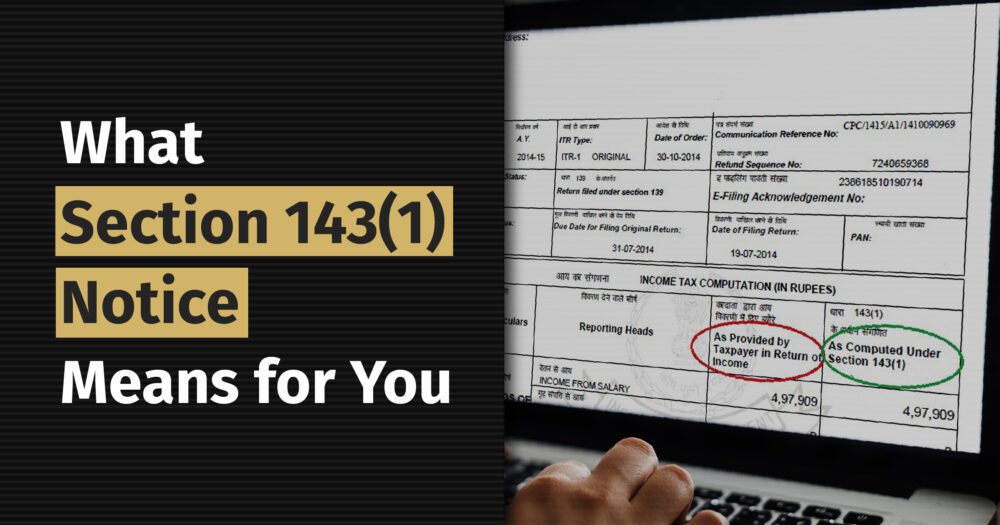

Received a Notice under Section 143(1)? Here’s what it means

Receiving a notice under Section 143(1) is a routine part of the income tax return process.…

7 min read

Embassy REIT: High yield or office space risk? Read this before you invest

Know the risks and rewards of investing in Embassy REIT before you decide.

5 min read

Applicability of Tax-Loss Harvesting Strategy in 2024

Rohit had a diverse investment portfolio in 2023. By December, he realised he had the following…

5 min read

Who Are You, Financially? Discover Your Financial Personality With MoneySign® to Make Smart Money Decisions

Everyone has a unique personality, which shapes how we think, act, and interact with the world.…

6 min read

IDFC FIRST Wealth Credit Card review 2026

IDFC First Wealth Credit Card: Can a life-time premium credit card exist?

Discover your MoneySign®

Identify the personality traits and behavioural patterns that shape your financial choices.