1 Finance Blog

Discover financial wisdom on our blog for expert insights on personal finance, investing, and money management.

4 min read

Understanding the Mechanics of Decentralized Exchanges

Explore our in-depth analysis on the rise of Decentralized Exchanges in India, their potential to revolutionize…

4 min read

How to Save Capital Gain Tax in 2025?

Capital gains tax is a type of tax levied on the profits earned from the sale…

6 min read

ITR filing for FY 2024-25: What is income tax return filing, who needs to file ITR, and what are the benefits of filing ITR?

Understanding the basics of ITR is essential. What is income tax return? What is the last…

8 min read

Role of Financial Advisor in Client Behaviour Management

Summary: Explore the transformative role of financial advisors in managing client behaviour. This blog delves into…

7 min read

Mis-selling by banks: Is the bank trying to scam you? How to protect yourself

Identify bank mis-selling and learn how to safeguard your investments.

3 min read

Mutual Fund Taxation in India (FY 2024-25): What Investors Need to Know

Mutual funds continue to be one of the most popular investment options for individuals and institutions…

7 min read

How to Invest in Mutual Funds

“Mutual funds were created to make investing easy, so consumers wouldn’t have to be burdened with…

8 min read

How to Compare Credit Cards

Credit cards—often viewed as a great tool of convenience by some due to their ease of…

3 min read

Optimizing Your Credit Card Usage: Strategies for Reward Maximization

Dive into our exploration of credit card strategies, unlocking the potential for significant savings and benefits…

7 min read

4 Smart Ways to Reduce Your Home Loan Interest Rate While Paying EMIs

Home loan borrowers can look forward to lower interest rates in 2025, following the Reserve Bank…

3 min read

How do Credit Cards Work

In today’s fast-paced, digital world, credit cards have become an indispensable financial tool for millions of…

7 min read

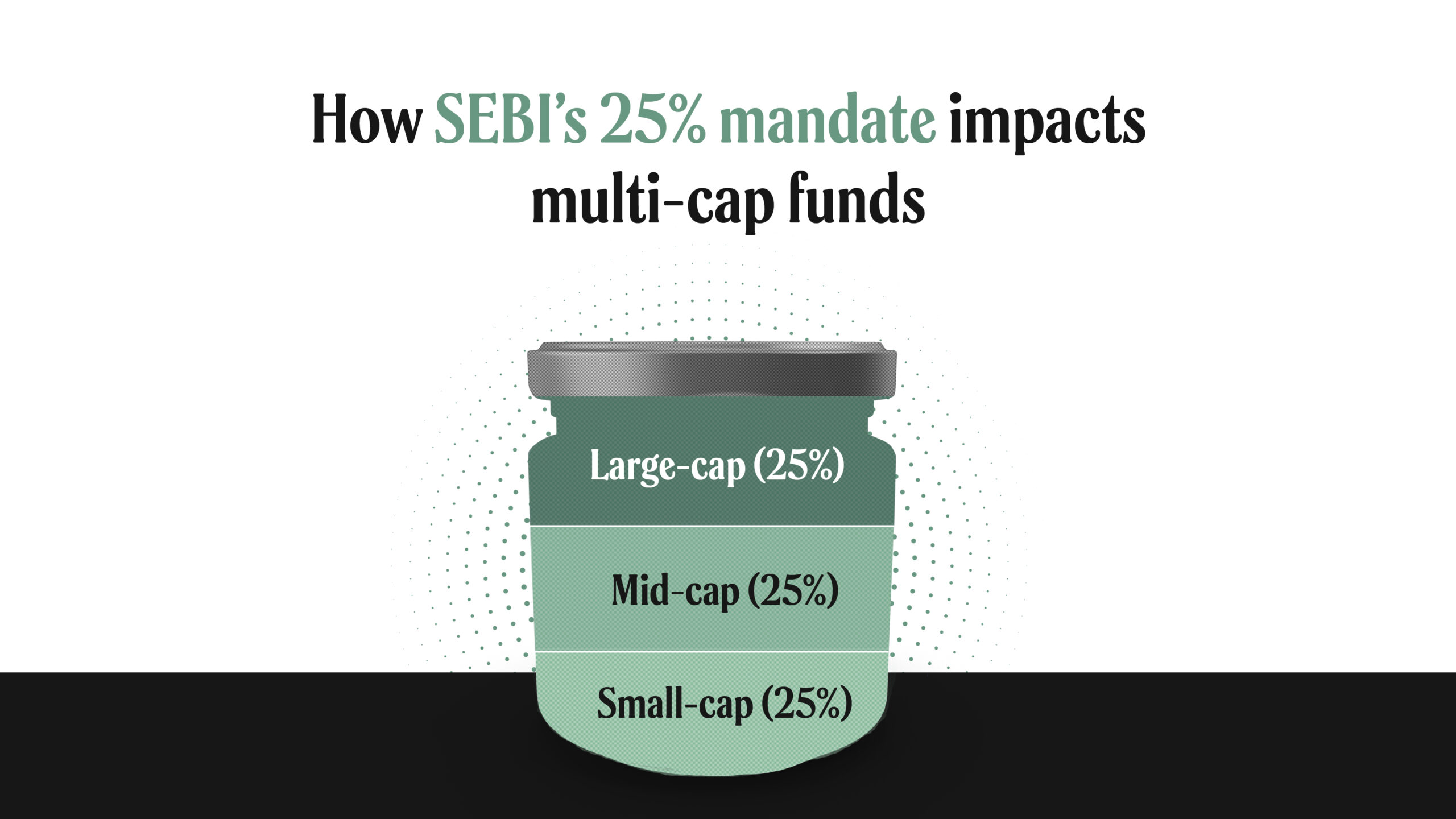

The multi-cap funds dilemma: Is the 25% allocation rule holding fund managers back?

Understand how 25% allocation rule impact multi-cap fund strategies and returns.

Discover your MoneySign®

Identify the personality traits and behavioural patterns that shape your financial choices.