1 Finance Blog

Discover financial wisdom on our blog for expert insights on personal finance, investing, and money management.

3 min read

Why Financial Planning Is More Important Than Ever in 2025

The financial world in 2025 is more dynamic and unpredictable than ever. Rapid technological advancements, shifting…

4 min read

SEBI’s Mutual Fund Categorisation Guide That Every Investors Should Understand

In 2017, the Securities and Exchange Board of India (SEBI) introduced new guidelines to categorise and…

SEBI’s New Circular: How It Will Help Families Discover Deceased’s Assets

Death doesn’t come knocking. Apart from dealing with the emotional pain of losing a family member,…

6 min read

What is a Will in India?

A will is a legal document that allows an individual, known as the testator, to dictate…

4 min read

Everything You Need To Know About Hindu Undivided Family: What Is Hindu Undivided Family And How To Create One?

When it comes to tax planning in India, the Hindu Undivided Family (HUF) structure is a…

5 min read

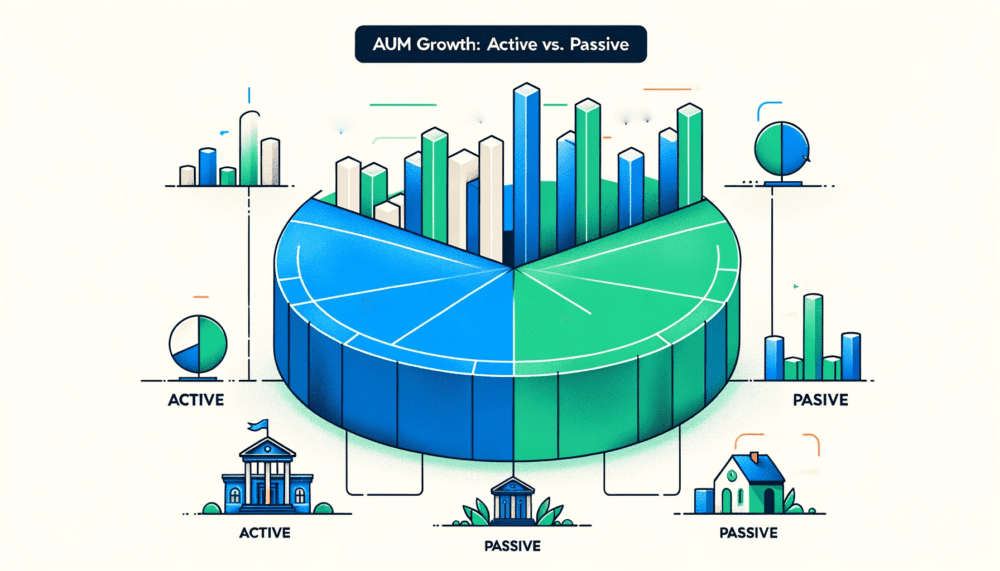

SPIVA Report – Unveiling the Active vs. Passive Debate

The ongoing debate between active and passive funds has become a staple in the financial world.…

3 min read

Navigating Tax Implications of P2P Lending in India

Peer-to-Peer (P2P) lending, also known as social lending, is gaining significant traction in India as a…

3 min read

Understanding Credit Scores and Their Importance in Personal Loans

In the world of personal finance, few things carry as much weight as your credit score.…

4 min read

Capital Gains from Equity and Mutual Funds: Special Considerations Under Section 111A & 112A

Income tax laws have distinct rules for the taxation of equity shares and mutual funds. To…

4 min read

Crypto Wallets: Safeguarding Digital Assets in the Indian Financial Landscape

Crypto wallets are essential tools for secure digital asset management in India's evolving cryptocurrency ecosystem.

3 min read

A Step-by-Step Guide to Transfer Your EPF Online

Transferring your Employees’ Provident Fund (EPF) account when you change jobs is essential to ensure the…

4 min read

How to invest in the US stock market from India

They say diversification is the only free lunch in investing. We all understand the importance of…

Discover your MoneySign®

Identify the personality traits and behavioural patterns that shape your financial choices.