1 Finance Blog

Discover financial wisdom on our blog for expert insights on personal finance, investing, and money management.

4 min read

How to Get Rid of Credit Card Debt

Credit card debt in India has been on the rise, leading to significant concerns. As of…

5 min read

The Intersection of Insurance and Risk Management: Your Guide to Financial Security

In today’s fast-paced world, managing risk is more important than ever. Whether you’re protecting your family’s…

5 min read

What is a REIT in India and How Can You Invest in REIT?

Imagine owning a piece of premium commercial real estate in Mumbai, Bangalore, or Delhi—without shelling out…

5 min read

Investing in unlisted shares? Here are the risks that every retail investors should know about

Unlisted shares are tempting, but investing in them is full of risk and danger.

8 min read

What are the Pros and Cons of Loan Refinancing?

Unlock the intricacies of loan refinancing in India to make well-informed financial choices with our comprehensive…

6 min read

Asset allocation : Why macroeconomics matters

While building a personal finance plan, one of the biggest decisions you’ll face is how to…

7 min read

How to Calculate Credit Card Interest

Credit cards can be incredibly convenient for making purchases and managing expenses, but they come with…

5 min read

Form 15G & Form 15H: Overview, Usage, Parts, and Eligibility

If you have completed your tax filing for 2023-24 and are now looking to maximise your…

5 min read

Understanding the Married Women’s Property Act (MWP Act): Safeguarding Your Family’s Future

Imagine a scenario where Raj, a successful entrepreneur, diligently plans for his family’s future. He invests…

6 min read

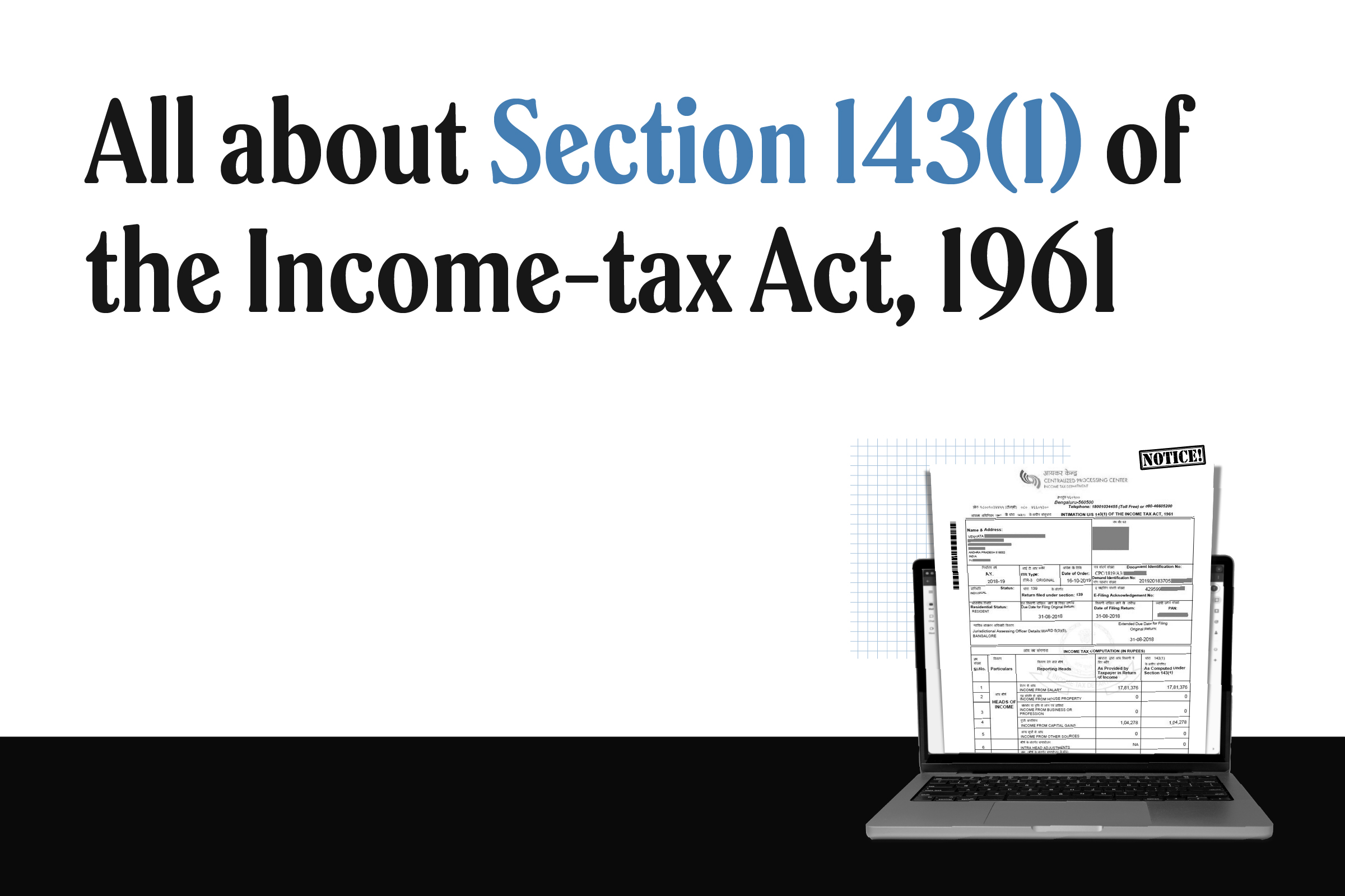

What is Section 143(1) intimation under the Income Tax Act, and what should you do if you receive one?

Learn about Income-tax Act Section 143 (1)

5 min read

A Unique Proposition of NFTs

Exploring the world of Non-Fungible Tokens (NFTs), this blog delves into their unique proposition in the…

4 min read

Property in Thane: Should you invest in Thane district real estate in 2025?

Thane offers a Mumbai-like lifestyle at more affordable prices. It has a track record of solid…

Discover your MoneySign®

Identify the personality traits and behavioural patterns that shape your financial choices.